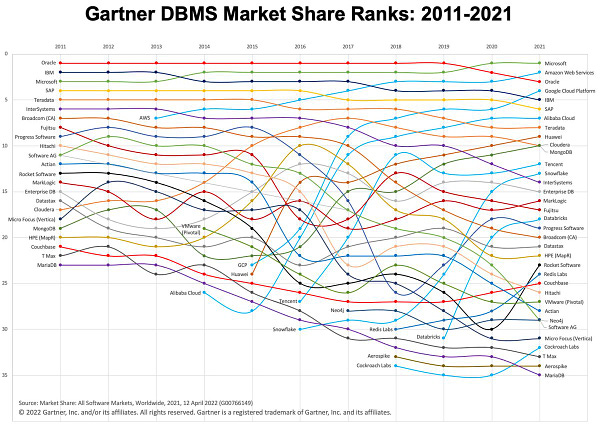

Gartner: Microsoft #1 in Database Revenue; AWS Passes Oracle; Google Cloud GainsThe Top 5 vendors concede ground to the rest of the packI just returned from a week’s vacation, and the database industry has been relatively quiet except for this: Oracle dropped a notch in database revenue marketshare, ceding its former #2 position to AWS, according to Gartner. Also: Microsoft ranked #1 in 2021, as it did the previous year. Google Cloud moved up into the #4 spot, displacing SAP. IBM dropped to #5. So Gartner’s top 5 ranking by database revenue for 2021 looks like this:

As you can see, Microsoft and AWS are neck and neck at #1 and #2. You can read Gartner analyst Merv Adrian’s overview here. The changes are not surprising. As I wrote in January,

Meanwhile, Oracle, IBM, and SAP each lost marketshare and slipped in the standing, in Gartner’s estimation. What Happened?How have the Big 3 cloud providers succeeded in nudging Oracle and the others down the Gartner marketshare ranking? In my earlier analysis, I identified the following characteristics that help explain the Big 3’s emergence as database powerhouses:

You can download my full industry analysis (published in February) below. Today I’m sharing the new Cloud Database Report 2022, which includes an updated list of the Cloud Database Top 20 vendor companies. This in-depth report is available to all subscribes as a PDF downlo… Read more3 months ago · John Foley ‘Stunning Growth’The changing of the guard is happening in a rapidly growing database market as more workloads continue to be deployed and migrated to cloud-based databases. Per Gartner, the DBMS market (on-premises and cloud combined) grew 22.3% in 2021 to nearly $80 billion. That’s twice the size of the market five years ago. Cloud services represented 49% of database revenue in 2021. “The growth has been stunning,” notes Adrian. Gartner analyst Adam Ronthal shared the chart below that shows the DBMS musical chairs over the past 10 years. It's April... and that means it's time for a fresh bowl of #DBMS spaghetti. This year's DBMS revenue rankings shows #cloud continuing to surge as hyperscalers solidify their market position. As always, pure-play cloud vendors are in light blue. #GartnerDA #datamanagement The Rise of Cloud-NativeDuring 2021, the big, established database vendors gave up ground to rising cloud-native database providers like MongoDB, Snowflake, Databricks, et al. The top 5 accounted for 80.6% of overall market revenue in 2021, down from 86.9% the previous year. Even Microsoft, at #1, lost a bit of share year to year — 24.0% in 2021 vs. 24.3% in 2020. It seems almost certain from Gartner’s trend analysis that 2022 will be the year that cloud DB revenue surpasses on-prem revenue. In other words, legacy vendors will be under continued pressure. Revenue vs. InnovationIt should be noted that this latest Gartner report is an estimate of marketshare based on revenue. A vendor may have lots of innovation but little revenue. And vice versa. Gartner’s Major Quadrant for Cloud DBMSes better reflects the relative strengths of competitors using criteria other than revenue. It’s a different lens into the market. See my earlier post on Gartner’s MQ below. Gartner’s famous Magic Quadrant has long served as a proof point of a vendor’s relevance in its respective market. I get emails and press releases from companies that make the list. And crickets from those who don’t… Read more2 months ago · John Foley You’re a free subscriber to Cloud Database Report. For the full experience, become a paid subscriber. © 2022 John Foley Unsubscribe |

ERP documents are collection from various sources. We don't create them. They are created and owned by mentioned respective authors.

Document Authors: No copyright infringement intended. If you want us to add / remove this content, please let us know by writing to goodreads @ onlyerp dot com

Gartner: Microsoft #1 in Database Revenue; AWS Passes Oracle; Google Cloud Gains

Gartner: Microsoft #1 in Database Revenue; AWS Passes Oracle; Google Cloud Gains

The Top 5 vendors concede ground to the rest of the pack

Parent Category: Articles

Good Reads

Hits: 493

Adam Ronthal @ARonthal

Adam Ronthal @ARonthal